Return on Common Equity Formula

When equity shrinks ROE increases. Therefore for a company with no debt its assets and shareholders equity will be equal.

What Is The Return On Common Equity Ratio Bdc Ca

Our financial experts use internal rate of return examples to teach you how to calculate IRR with ease.

. ROA gives a manager investor. Return On Equity - ROE. IRR is the internal rate of return Internal Rate Of Return Internal rate of return IRR is the discount rate that sets the net present value of all future cash flow from a project to zero.

ROIC is frequently used to determine the efficiency at which capital is allocated because the consistent generation of a positive value is perceived positively as a necessary attribute of a quality business. But if the company takes on new debt assets increase because of the influx of cash and equity shrinks because equity assets liabilities. Thanks for reading this article and if you think this article needs some improvement please drop it below.

Still a common shortcut is to compare a companys performance to the long-term average ROE of the SP 500 which stands at 14 as acceptable and everything below 10 as quite poor. Return on Assets - ROA. Like we have discussed above the time value of money has been ignored in the average rate of return formula.

Cost of Equity Formula. Return on Assets ROA is a type of return on investment ROI metric that measures the profitability of a business in relation to its total assetsThis ratio indicates how well a company is performing by comparing the profit its generating to the capital its invested in assetsThe higher the return the more productive and. If the required rate of return from the project is sat 10 and the average rate of return is coming out to be 15 that project will look worth investing.

0 NPV P0 P11IRR P21IRR2 P31IRR3. Read more provide us with the same answer. By following the formula the return that XYZs management earned on shareholder equity was 1047.

Assets liabilities equity. For example if the debenture interest rate is around 5 then the return on equity around 10 to 15 is quite good. Cite this calculator page.

A good return on equity also depends on the board of directors rate previous year rate and industry rate. The shareholders equity consists of only the common shareholders of Colgate. ROE Net Income Total Equity.

Return on equity measures a corporations profitability by revealing how. It compares and selects the best project wherein a project with an IRR over and above the minimum acceptable return hurdle rate is selected. Return on Invested Capital ROIC measures the percentage return of profitability earned by a company using the capital invested by equity and debt providers.

However calculating a single companys return on equity rarely tells you much about the comparative value of the stock since the average ROE fluctuates significantly between industries. We note that the asset turnover. ROA Formula Return on Assets Calculation.

Return on assets ROA is an indicator of how profitable a company is relative to its total assets. Despite the widespread criticism from academia as well as practitioners the capital asset pricing model CAPM remains the most prevalent approach for estimating the cost of equity. The formula for ROE used in our return on equity calculator is simple.

That can be detrimental and can lead us to make the wrong capital investment decision. The CAPM links the expected return on securities to their sensitivity to the broader market typically with the SP 500 serving as the proxy for market returns. Internal Rate of Return Formula.

Return on equity ROE is the amount of net income returned as a percentage of shareholders equity. However DuPont analysis helps us analyze why there was an increase or decrease in ROE. The IRR formula is as follows.

The formula is Return on Equity ROE Profit Margin Total Asset Turnover Leverage Factor. The IRR method is best suited for analyzing venture capital and private equity investments. Finally the formula for an annualized rate of return can be derived by dividing the sum of initial investment value step 1 and the periodic gains or losses step 2 by its initial value which is then raised to the reciprocal of the holding period step 3 and then minus one as shown below.

Also the ROE and the ROA will be equal.

Return On Common Equity Definition And Example Corporate Finance Institute

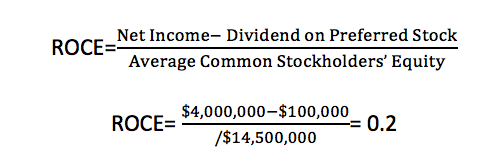

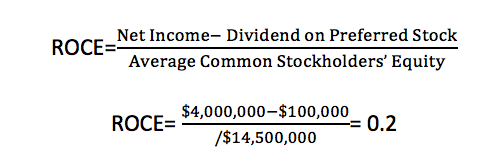

Return On Common Stockholders Equity Roce Formula Example

Return On Equity Roe Formula Examples And Guide To Roe

Rate Of Return On Common Stockholder S Equity Roe Youtube

0 Response to "Return on Common Equity Formula"

Post a Comment